Examples of project financing in the real estate sector of landowners, developers, or property dealers

To know more about itExamples of SME financing online

Since its creation in 2016, more than 150 projects have been put online on the marketplace FirmFunding, for a total of more than 800 M euros. As these examples of projects show, the financing of companies by private debt makes it possible to finance any type of project (asset financing, internal growth, external growth, exit of shareholders, transmission…) in all sectors of activity (industry, health, agri-food, audiovisual, real estate development...), for amounts ranging from 1 to 20 million euros. FirmFunding thus makes this type of high of balance sheet financing, regardless of its structure (full bond, equity/bond mix and equity) accessible to growth SMEs.

Our teams are at your disposal to examine the eligibility of your projects (Turnover > 5 million euros - Ebitda >0 - Project amount > 1 million euros).

Asset financing

Industry

Funding < 5M€

Great-East

Bondholder

Build up

Health

Funding > 10M€

Île-De-France

convertible bond

Shareholder exit

Agri-food

Funding < 5M€

Occitania

Bondholder

Internationalization

B2C/B2B Services

Funding < 5M€

Île-De-France

Bondholder

Transmission (MBO)

IT Council

Funding < 5M€

Île-De-France

Mix Equity/Dette

Funding of projects

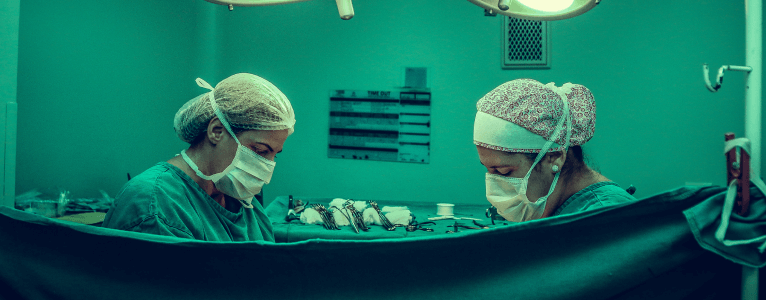

Real estate developer

Funding < 5M€

New Aquitaine

Bondholder

Transmission (OBO)

Cosmetic / Perfumes

Funding > 10M€

Île-De-France

convertible bond

Organic growth

Audiovisual

Funding < 5M€

Île-De-France

Bondholder

Asset financing

Industry

Funding < 5M€

Rhônes-Alpes

Bondholder

Organic growth

B2C/B2B Services

Funding > 5M€

New Aquitaine

Mix Equity/Dette

Financed sectors

No sector is excluded as a matter of principle. SMEs with projects can belong to any sector, provided that the platform's minimum intervention criteria are respected, namely: project amount to be financed between 1 and 20 million euros, a company with a turnover of about 5 million euros per year, and profitable or about to be profitable. More than the sector of activity, it is therefore the SME's financial metrics and the maturity of its business that will count. Indeed, the structuring of the financing obtained, between equity (shares), and/or convertible bonds and pure private debt (dry bonds) often depends on these last aspects.

FirmFunding is delighted to allow SMEs from various sectors, close to our values, to finance their development and thus participate in their highlighting. Find these sectors here:

Examples of equity financing of farms within the framework of sustainable agriculture projects

To know more about itExamples of project financing in the real estate sector of landowners, developers, or property dealers

To know more about itExamples of equity financing of farms within the framework of sustainable agriculture projects

To know more about itThey trust us

Our testimonials talk about FirmFunding, the marketplace dedicated to private placement. Discover our testimonials about FirmFunding, a vehicle for financing the growth of SMEs.

OnetoOne corporate

Jean-Luc Bertrand, Partner at ONEtoONE Corporate Finance

To know more about it

Entrepeneur Venture

Marouane Bahri, Investment Director at Entrepreneur Venture

To know more about it

Financiere arbevel

Sébastien Lalevée, Managing Director at Financière Arbevel

To know more about it

Solutions Fiducie

Patrice Paganet - Co-founder of Solutions Fiducie

To know more about it

Jeausserand Audouard

Marie-Paule Noel, artner at Jeausserand Audouard

To know more about it

OnetoOne corporate

Jean-Luc Bertrand, Partner at ONEtoONE Corporate Finance

To know more about it

Entrepeneur Venture

Marouane Bahri, Investment Director at Entrepreneur Venture

To know more about it

Financiere arbevel

Sébastien Lalevée, Managing Director at Financière Arbevel

To know more about it

Solutions Fiducie

Patrice Paganet - Co-founder of Solutions Fiducie

To know more about it

Jeausserand Audouard

Marie-Paule Noel, artner at Jeausserand Audouard

To know more about it

Our latest news

SMEs financing trends

2024 Barometer of equity and bonds financingThe FirmFunding barometer 2024, the leading digital platform for SME private debt financing in France

To know more about itPrivate debt financing

Interview with Florence Vasilescu - may 2024The benefits of investing directly in SMEs for clients of wealth management advisors

To know more about itBlog

Investisseur.TVInterview with Florence Vasilescu - march 2023

To know more about itAn adapted solution for SME financing

What is FirmFunding ?

FirmFunding is the first and only financing platform dedicated to private placement (bond and equity) for SMEs. To finance their growth, SMEs need to have at their disposal other sources of financing than bank loans.

FirmFunding is a marketplace that aims to connect SME advisors with professional investors, when a private placement financing project is released online.

The online process is very simple: the board / SME posts the documents needed to present the financing project, which registered investors can consult before contacting them.

The FirmFunding platform:

For which types of financings ?

Provided you are a profitable or soon-to-be profitable joint-stock company with sales in excess of 5 million euros, all types of project are likely to be financed at least in part by recourse to equity financing:

- All types: development (organic growth, external growth), transmission (MBO, MBI, OBO, exit of minority shareholders, etc.), refinancing, asset financing.

- All sectors: services, agro, real estate, industry, consulting, technologies...

- Regardless of the headquarter location: whole France and the EU.

Why finance your business with FirmFunding ?

FirmFunding already has more than 300 registered professional investors with a total financing capacity of more than €3 billion. These investors are essentially management company and family offices. €800 million of corporate financings have been uploaded since its creation.

Investors registered on the FirmFunding platform can thus provide a source of financing to strengthen the (quasi-) equity capital of SMEs, in complementarity with the bank, without diluting the founding shareholders.

Contact us

By email via the contact form